Alliance Group Ltd is pleased to announce the unanimous selection of European red meat processor Dawn Meats Group as our preferred strategic investment partner.

As you know, over the last 2 years we have conducted a thorough process to reset and recapitalise Alliance. Attracting capital to our sector in challenging market conditions has not been easy, so it is a testament to both the improvements delivered through our business reset and the robust process led by our independent professional advisors that we stand where we are today, with an opportunity to galvanise our future.

Alliance has been a proud farmer-owned co-operative since 1980. Our business was built by – and we are very grateful to – the many farmers who have given decades of loyal commitment to Alliance.

We have reached a point where our choices have become increasingly difficult, and Alliance must now evolve. Nevertheless, our commitment to farmers remains the same. We believe Dawn Meats’ investment offer stands to create a highly strategic partnership – their strength in Beef and ours in Lamb with year-round supply of sustainably farmed, grass-fed animals – unlocking future value for our farmers. Dawn Meats also has a ‘can-do’, keep-it-simple and common-sense operating culture, which the Board believes aligns naturally with Alliance.

Mark Wynne

Alliance Chairman

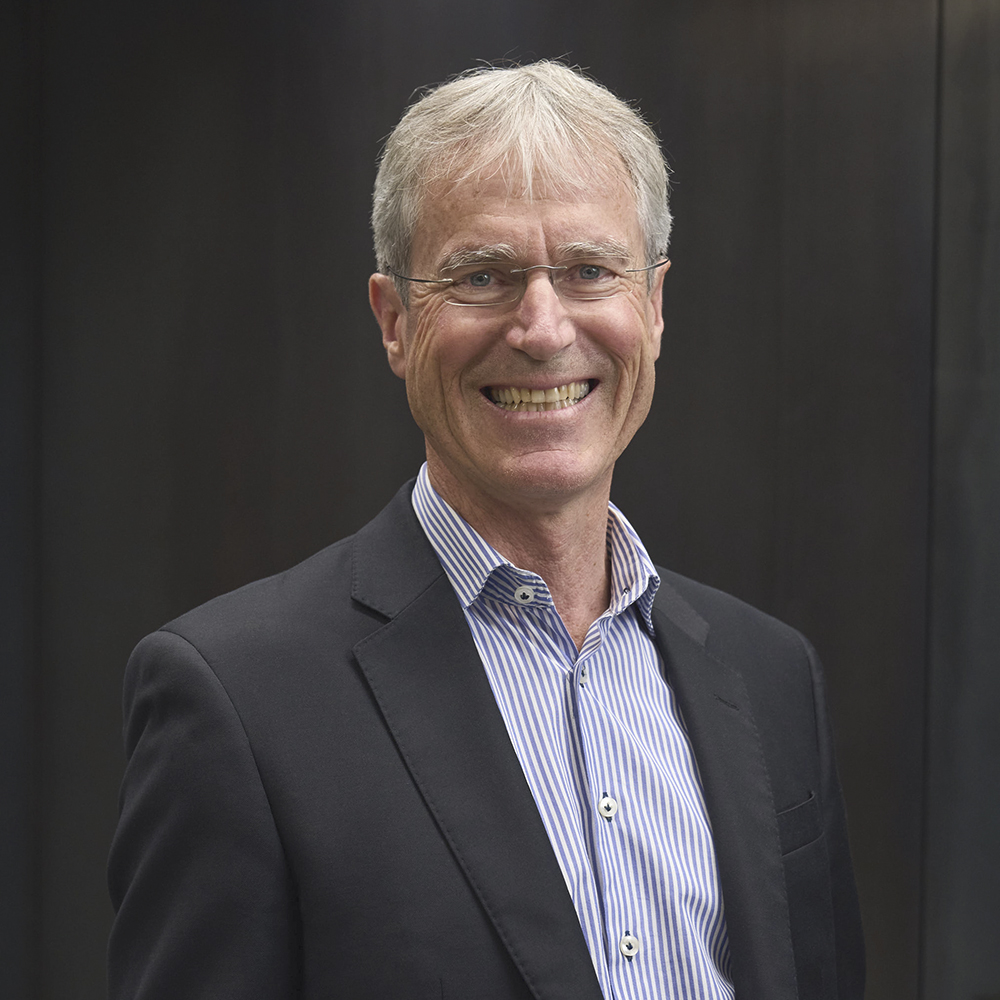

Introducing Dawn Meats Group

- 11 sites in Ireland, 13 in UK including 4 retail packing facilities for retail and foodservice and 2 frozen burger facilities.

- Key supplier of McDonald’s, significant exposure UK/EU Retailers and Foodservice

- Offices in Ireland, UK, France, Spain, Italy, The Netherlands, Germany and Poland

- Close relationships with more than 40,000 farming families who supply direct

Why we want to partner with Alliance

“Dawn Meats has a proud and proven track record of generating growth through carefully planned and managed partnerships and acquisitions.

As our business continues to develop, we have and will always remain true to our farming heritage, thanks to the close relationships we have forged with the more than 40,000 family farms that supply us directly.

Our partnership with Alliance would ultimately create a dual-hemisphere, year-round supplier of leading-quality grass-fed red meat to existing and new customers throughout the world.

Joining forces would allow our companies to share access to our respective networks, building new relationships, and increase collaboration.

It would also allow for the sharing of expertise, operational practices, insights and innovations.

At Dawn Meats, we see the potential opportunity to partner with Alliance as a real privilege and believe our proposed investment offer can deliver immense benefit to both companies, creating a competitive edge that will allow both to continue to prosper and succeed.”

Niall Browne

Chief Executive Officer of Dawn Meats

Niall Browne

Chief Executive Officer of Dawn Meats

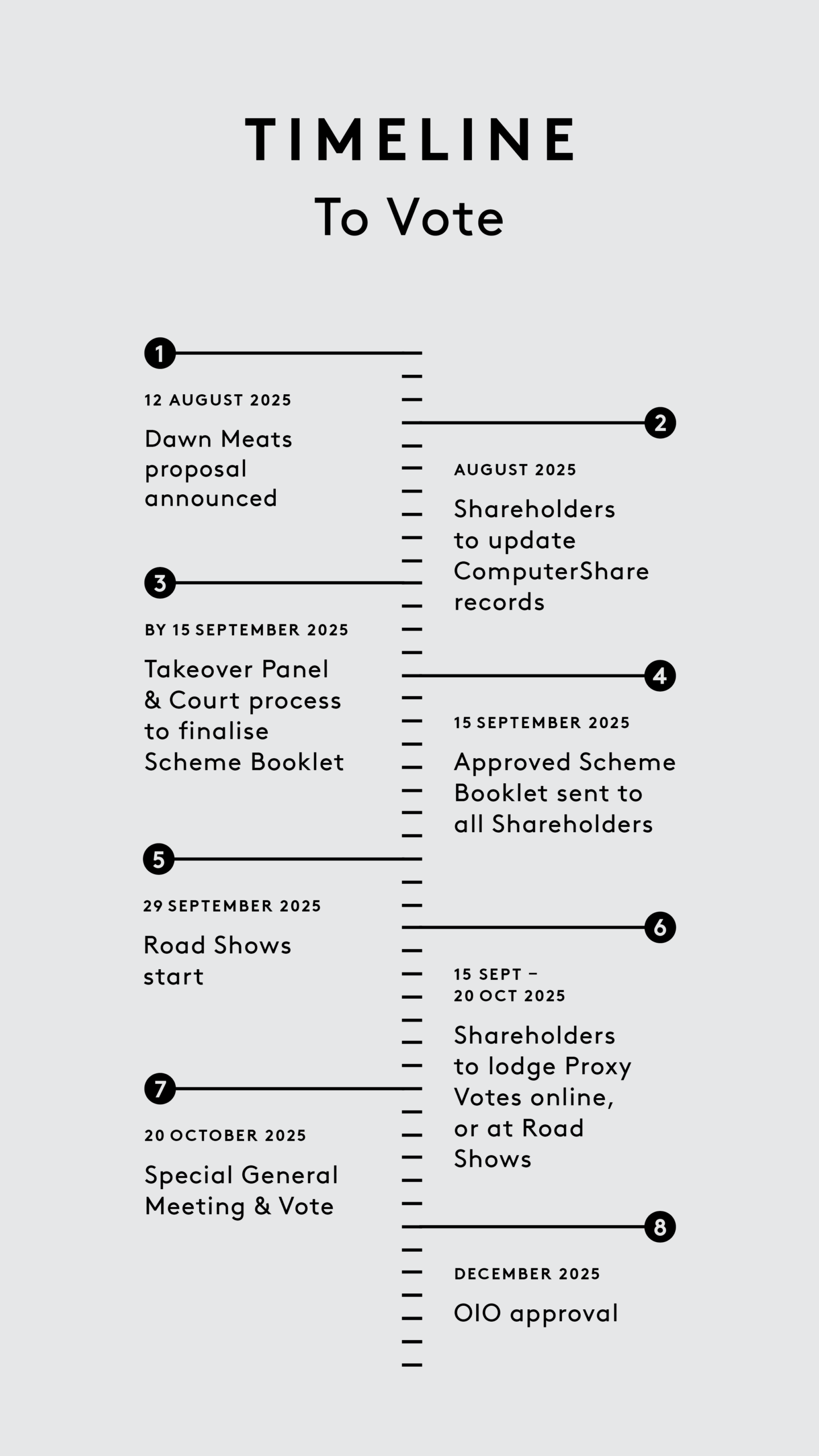

The proposed partnership

The proposed transaction would see Dawn Meats Group invest NZ$250 million, valuing Alliance at NZ$502 million on an enterprise basis, to acquire 65% of the shares in Alliance Group, subject to shareholder and regulatory approvals.

Proceeds from the transaction – circa $200 million – would be used to substantially reduce our short-term working capital facility by the end of the calendar year to meet banking requirements, accelerate the Board’s strategic capital expenditure, and enable up to $40 million distribution to the Co-Operative over the next two to three years.

Further information about the terms of these payments will be provided in the Scheme Booklet that will be issued to all shareholders by 15 September.

Subject to the vote outcome, Alliance Investment Co-op would secure a 35% shareholding in Alliance Group Limited — an entity with restored balance sheet strength and positioned for growth.

Your Company, Your Vote

By not voting, you are voting “No”

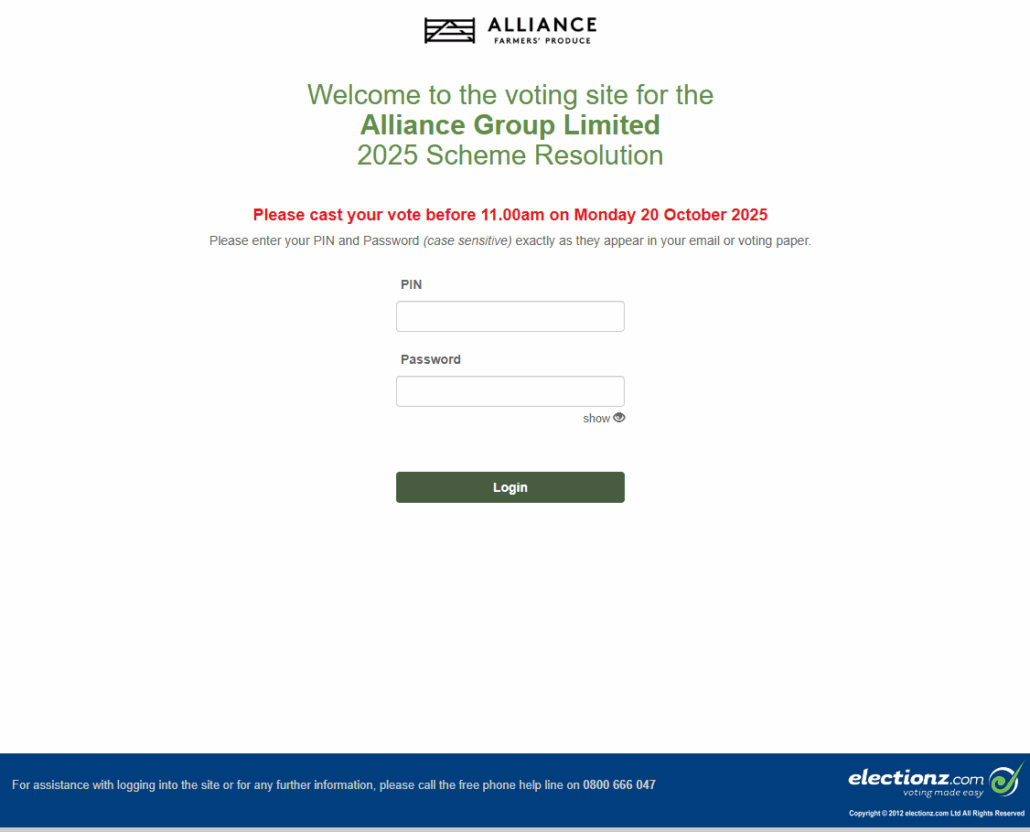

Shareholders will have received an email advising voting is now open. The email was sent by Electionz on 18th September. In the email there is a link to important documents that Shareholders are encouraged to read before casting their vote. If you no longer own shares in Alliance, please disregard.

How to Vote

- VOTE ONLINE

In the email you received on 18th September form Electionz there is a link to to vote online and a personalised pin and password.

Your email will look like this (example only):

Online voting link: https://ivote.electionz.com/

- VOTE IN PERSON: By attending the Special General Meeting in Invercargill on 20 October. If you are a corporate shareholder, you may need to appoint a proxy to vote on your behalf at the meeting.

- VOTE BY POST: Postal votes must be received by Electionz by 20 October.

You should read the Scheme Book carefully before deciding whether or not to vote in favour of the Scheme (as part of and in anticipation of implementation of the Dawn Meats investment).

If you are in doubt as to any aspect of the Scheme or the Dawn Meats investment, you should seek advice from your financial, taxation, or legal adviser before voting on the Scheme.

What happens next

The proposed transaction will be implemented via a Scheme of Arrangement and requires:

- Roadshows start 29 September

- At least 75% of voting shareholders to vote in favour.

- More than 50% of total shareholding to vote yes at a Special General Meeting (SGM) on 20 October 2025.

Roadshow and Locations

Register below for one of our upcoming Roadshow events to learn more about the proposed strategic investment.

| Date | Time | Location | Venue |

|---|---|---|---|

| Monday 29th Sept | 10:00-12:00 | Tuatapere | Waiau Town & Country Club 41 King Street, Tuatapere, 9620 |

| Monday 29th Sept | 14:00-16:00 | Mossburn | Mossburn Community Centre 9 Holmes Street, Mossburn, 9792 |

| Monday 29th Sept | 19:00-21:00 | Invercargill | Ascot Hotel 41 Racecourse Road, Invercargill |

| Tuesday 30 Sept | 10:00-12:00 | Winton | Winton Memorial Hall 2 Meldrum Street Winton, 9720 |

| Tuesday 30 Sept | 14:30-16:30 | Tokanui | Tokanui Memorial Hall 42 Tokanui-Haldane Road Tokanui, 9884 |

| Tuesday 30 Sept | 19:00-21:00 | Gore | Croydon Lodge 100 Waimea Street, Croydon, 9776 |

| Wednesday 1 Oct | 09:00-11:00 | Wyndham | Wyndham Memorial Hall 44 Balaclava Street, Wyndham, 9831 |

| Wednesday 1 Oct | 13:00-15:00 | Heriot | Heriot Community Centre 11 Nith Street, Heriot |

| Wednesday 1 Oct | 18:00-20:00 | Balclutha | South Otago Town and Country Club 1 Yarmouth Street, Balclutha |

| Thursday 2 Oct | 09:00-11:00 | Mosgiel | Mosgiel Coronation Hall 97 Gordon Road, Mosgiel, 9024 |

| Thursday 2 Oct | 13:30-15:30 | Oamaru | Brydone Hotel Oamaru 115 Thames Street, Oamaru, North Otago, 9400 |

| Thursday 2 Oct | 18:30-20:30 | Fairlie | Mackenzie Community Centre 53 Main Street, Fairlie, 7925 |

| Friday 3 Oct | 09:30 – 11:30 | Ashburton | Hotel Ashburton 11-35 Racecourse Rd, Ashburton, 7700 |

| Friday 3 Oct | 13:30-15:30 | Dunsandel | Dunsandel Community Centre 1456 Tramway Rd, Dunsandel |

| Friday 3 Oct | 18:00-20:00 | Omihi | Omihi Community Hall 9 Reeces Road, Omihi, 7483 |

| Monday 6 Oct | 09:00-11:00 | Nelson | Beachside Nelson 70 Beach Rd, Tahunanui, Nelson, 7011 |

| Monday 6 Oct | 14:30-16:30 | Blenheim | Scenic Hotel Marlborough 65 Alfred Street, Blenheim, 7201 |

| Tuesday 7 Oct | 09:30-11:30 | Masterton | Copthorne Solway Park Conference Centre High Street, Solway, Masterton, 5810 |

| Tuesday 7 Oct | 14:00-16:00 | Feilding | Feilding Golf Club 1487 Waughs Road, Aorangi 4775 |

| Tuesday 7 Oct | 18:00-20:00 | Dannevirke | Dannevirke Services & Citizens Club 1 Princess Street, Dannevirke, 4930 |

| Wednesday 8 Oct | 09:00-11:00 | Hastings | Havelock North Function Centre 30 Te Mata Road, Havelock North, 4130 |

| Monday 13 Oct | 10:30-12:30 | Virtual Roadshow | Online webinar, link in registration email. |

| Tuesday 14 Oct | 09:00-11:00 | Alexandra | Centennial Court Hotel, 96 Centennial Avenue, Alexandra 9320 |

| Tuesday 14 Oct | 14:00-16:00 | Middlemarch | Strath Taieri Community Centre, Cnr Swansea St & Browns Rd, Middlemarch 9597 |

Monday 29th Sept | 10:00-12:00 | Tuatapere

Waiau Town & Country Club, 41 King Street, Tuatapere 9620

Monday 29th Sept | 14:00-16:00 | Mossburn

Mossburn Community Centre, 9 Holmes Street, Mossburn 9792

Monday 29th Sept | 19:00-21:00 | Invercargill

Ascot Hotel, 41 Racecourse Road, Invercargill

Tuesday 30 Sept | 10:00-12:00 | Winton

Winton Memorial Hall, 2 Meldrum Street Winton, 9720

Tuesday 30 Sept | 14:30-16:30 | Tokanui

Tokanui Memorial Hall, 42 Tokanui-Haldane Road Tokanui, 9884

Tuesday 30 Sept | 19:00-21:00 | Gore

Croydon Lodge, 100 Waimea Street, Croydon 9776

Wednesday 1 Oct | 09:00-11:00 | Wyndham

Wyndham Memorial Hall, 44 Balaclava Street, Wyndham 9831

Wednesday 1 Oct | 13:00-15:00 | Heriot

Heriot Community Centre, 11 Nith Street, Heriot

Wednesday 1 Oct | 18:00-20:00 | Balclutha

South Otago Town and Country Club, 1 Yarmouth Street, Balclutha

Thursday 2 Oct | 09:00-11:00 | Mosgiel

Mosgiel Coronation Hall, 97 Gordon Road, Mosgiel 9024

Thursday 2 Oct | 13:30-15:30 | Oamaru

Brydone Hotel Oamaru, 115 Thames Street , Oamaru , North Otago 9400

Thursday 2 Oct | 18:30-20:30 | Fairlie

Mackenzie Community Centre, 53 Main Street, Fairlie 7925

Friday 3 Oct | 09:30 – 11:30 | Ashburton

Hotel Ashburton,11-35 Racecourse Rd, Ashburton, 7700

Friday 3 Oct | 13:30-15:30 | Dunsandel

Dunsandel Community Centre, 1456 Tramway Rd, Dunsandel

Friday 3 Oct | 18:00-20:00 | Omihi

Omihi Community Hall, 9 Reeces Road, Omihi 7483

Monday 6 Oct | 09:00-11:00 | Nelson

Beachside Nelson, 70 Beach Rd, Tahunanui, Nelson 7011

Monday 6 Oct | 14:30-16:30 | Blenheim

Scenic Hotel Marlborough, 65 Alfred Street, Blenheim 7201

Tuesday 7 Oct | 09:30-11:30 | Masterton

Copthorne Solway Park Conference Centre, High Street, Solway, Masterton 5810

Tuesday 7 Oct | 14:00-16:00 | Feilding

Feilding Golf Club, 1487 Waughs Road, Aorangi 4775

Tuesday 7 Oct | 18:00-20:00 | Dannevirke

Dannevirke Services & Citizens Club, 1 Princess Street, Dannevirke 4930

Wednesday 8 Oct | 09:00-11:00 | Hastings |

Havelock North Function Centre, 30 Te Mata Road, Havelock North 4130

Tuesday 14 Oct | 14:00-16:00 |

Strath Taieri Community Centre

Cnr Swansea St & Browns Rd, Middlemarch 9597

Tuesday 14 Oct | 09:00-11:00 | Alexandra

Centennial Court Hotel, 96 Centennial Avenue, Alexandra 9320